Keeping your family healthy is your top priority, but navigating the complexities of family health insurance can feel like wrestling a herd of kittens. Fear not! This guide equips you with the knowledge and confidence to choose the plan that safeguards your loved ones without breaking the bank.

Do you need insurance?

Unexpected medical bills can derail any family budget. Family health insurance offers peace of mind, knowing your loved ones have access to quality care without financial worries. Plus, it often simplifies claims and administrative processes compared to multiple individual plans.

Who qualifies?

Anyone can purchase family health insurance, regardless of employment status or pre-existing conditions. Family typically includes spouses, dependent children under 26 (even if married), and sometimes adopted children or foster children.

What does it cover?

Plans typically cover preventive care, doctor visits, hospitalization, various procedures, and sometimes prescriptions. Coverage details vary across plans, so compare carefully. Consider optional riders for dental, vision, or additional benefits.

What does it cover?

Plans typically cover preventive care, doctor visits, hospitalization, various procedures, and sometimes prescriptions. Coverage details vary across plans, so compare carefully. Consider optional riders for dental, vision, or additional benefits.

Tips & Tricks

Open Enrollment Period

This annual window (typically November-January) is your primary opportunity to enroll in a new plan or change your existing one. Mark your calendar!

Assess Your Family's Needs

Consider everyone's health status, anticipated use, and ages to narrow down plan options.

Network size

Choose a plan with a network that includes your preferred doctors and hospitals to minimize out-of-network costs.

Schedule Free Audit

Understand Key Costs: Know deductibles, copays, and coinsurance. Choose a plan that balances affordability with coverage needs. Talk with a licensed agent to understand your deductibles, copays, and coinsurance and ensure you have the best option.

Common Plans

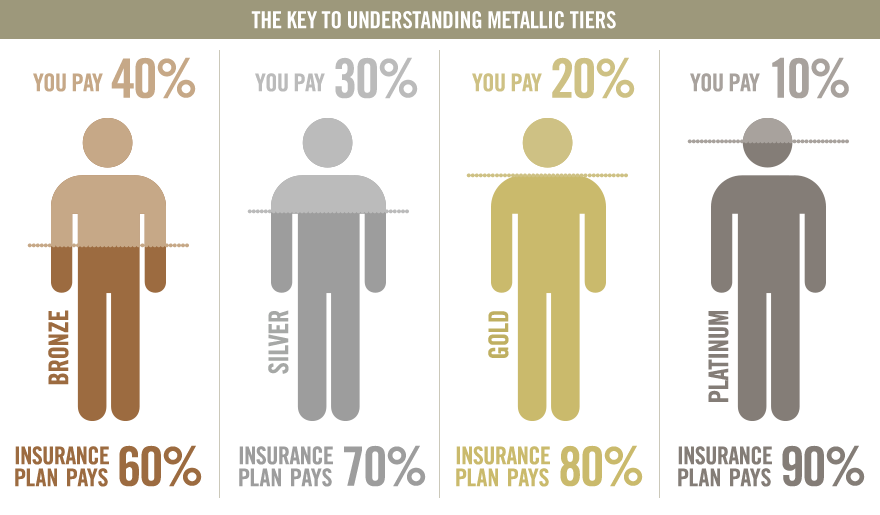

Bronze

Lower premiums, but higher deductibles and out-of-pocket costs. Good for healthy families with minimal healthcare needs.

Silver

Moderate premiums with balanced coverage and out-of-pocket costs. A popular choice for many families.

Gold

Lower deductibles and out-of-pocket costs, but higher premiums. Ideal for families with frequent healthcare needs or chronic conditions.

Platinum

Highest premiums, but minimal out-of-pocket costs and broadest coverage. Suitable for families with complex medical needs or seeking maximum peace of mind.

Common Plans

Pricing

Individual health insurance premiums vary considerably based on several factors:

Number of members

Adding more members increases the cost.

Age of family

Younger children typically cost less, while older members can raise premiums.

Location

Zip code significantly impacts premiums.

Plan choice

Bronze plans have the lowest premiums, while Platinum plans have the highest.

Understanding your health insurance options is a critical step towards protecting your financial well-being. We're here to support you every step of the way.