Navigating the world of individual health insurance can feel like deciphering ancient hieroglyphics. Worry not! This guide equips you with the knowledge and understanding to confidently choose the plan that fits your needs and budget.

Do you need insurance?

It protects you from unexpected medical expenses, ensuring access to quality care without financial strain.

Who qualifies?

Anyone can purchase individual health insurance, regardless of employment status or pre-existing conditions.

What does it cover?

Plans typically cover preventive care, doctor visits, hospitalization, and various procedures. Coverage details vary across plans, so compare carefully.

Tips & Tricks

Open Enrollment Period

This annual window (typically November-January) is your primary opportunity to enroll in a new plan or change your existing one. Mark your calendar!

Know your needs

Assess your health status, anticipated use, and budget to narrow down your plan options.

Consider network size

In-network providers offer reduced costs, so choose a plan with a network that fits your healthcare preferences.

Schedule Free Audit

Talk with a licensed agent to understand your deductibles, copays, and coinsurance and ensure you have the best option.

Common Plans

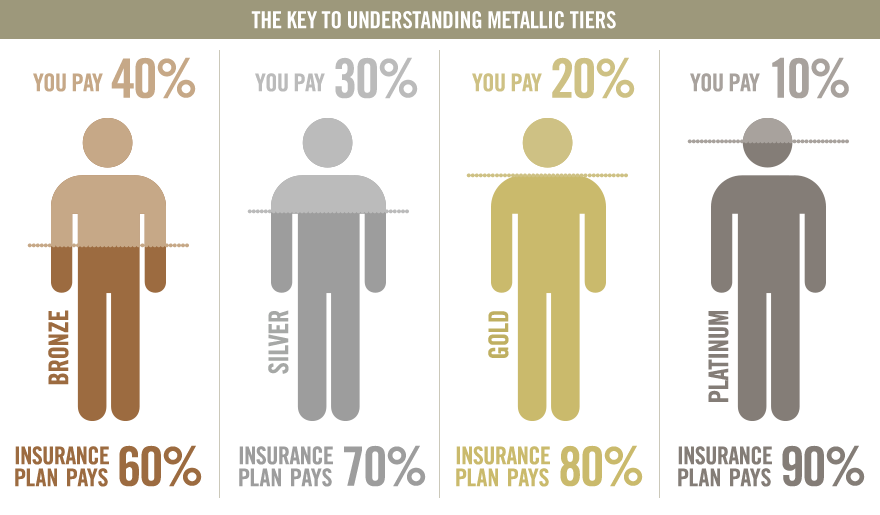

Bronze

Covers preventive care and essential services with higher deductibles and out-of-pocket costs.

Silver

Offers more comprehensive coverage with moderate deductibles and out-of-pocket costs.

Gold

Provides broader coverage with lower deductibles and out-of-pocket costs, but higher premiums.

Platinum

Offers the most comprehensive coverage with minimal out-of-pocket costs, but the highest premiums.

Common Plans

Pricing

Individual health insurance premiums vary considerably based on several factors:

Age

Younger individuals typically pay lower premiums than older individuals.

Location

Premiums can differ significantly based on your zip code.

Tobacco use

Smokers generally pay higher premiums than non-smokers.

Plan choice

Bronze plans have the lowest premiums, while Platinum plans have the highest.

Understanding your health insurance options is a critical step towards protecting your financial well-being. We're here to support you every step of the way.