Mitigating Risks

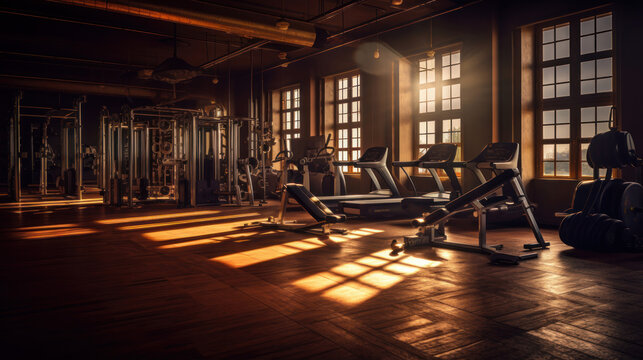

You've poured your heart and soul into building a thriving fitness community. But running a gym or studio comes with inherent risks. Accidents can happen, equipment can malfunction, and unexpected events can disrupt your operations. Standard insurance might not be enough to safeguard your business from these potential setbacks.

Protect your passion, your business, and your members with customized insurance solutions designed for the fitness industry.

General Liability

Protect yourself from slip-and-fall accidents, property damage claims from members, and other unforeseen liabilities.

Participant Injury

Ensure coverage in case a member gets injured while using your facilities or equipment.

Equipment Breakdown

Get financial protection against costly repairs or replacements for damaged exercise equipment.

Business Interruption

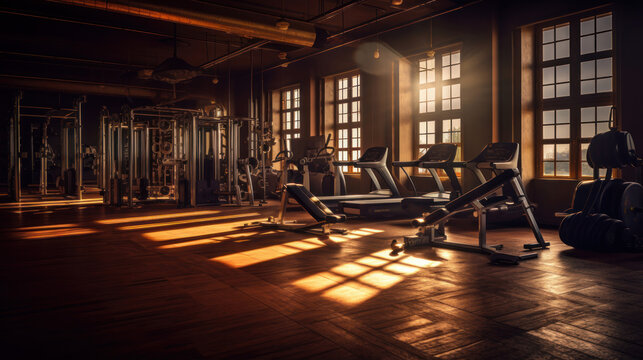

Mitigate financial losses if your gym is forced to close due to unforeseen circumstances like fire, weather events, or power outages.

Tailored to You

We understand that no two fitness businesses are identical. We offer a wide range of insurance options to cater to the specific needs of different gym and studio formats.

High-Intensity Training Gyms

Get specialized coverage for high-impact workouts, including participant injury and equipment breakdown protection.

Yoga & Pilates Studios

Find peace of mind with tailored policies that address potential slip-and-fall occurrences and prop-related injuries.

Boutique Fitness Centers

Protect your unique equipment and class offerings with customized coverage options.

Why Partner With Us?

We go beyond simply providing insurance policies. We offer additional resources to empower your fitness business.

Risk Management Consulting

Receive valuable advice on implementing safety protocols and minimizing potential liabilities within your gym or studio.

Group Fitness Instructor

Help your instructors obtain individual liability coverage for added peace of mind.

Claims Advocacy

In the event of an incident, our team can assist you with navigating the claims process to ensure a smooth resolution.